Singapore vs Dubai vs Hong Kong: Which Strategic Hub is Right for You?

The Great Jurisdictional Debate

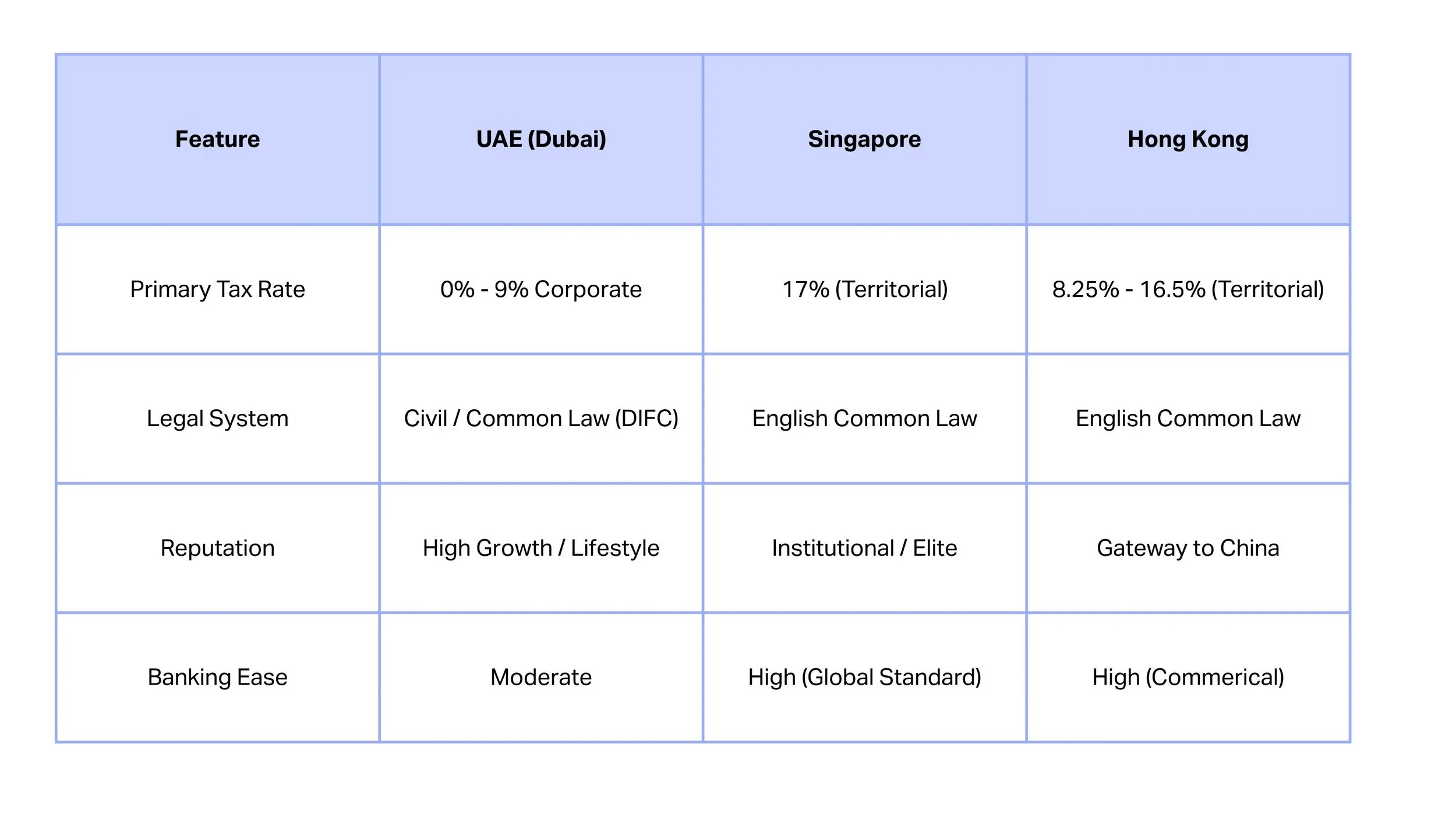

When architecting a global business, the choice of a ‘home base’ defines your scalability and tax efficiency. While Dubai, Singapore, and Hong Kong are often grouped together, their legal and operational nuances are vastly different.

Simple Jurisdictional Comparison Table

The Verdict

Dubai is the premier choice for those seeking immediate tax optimisation and a luxury lifestyle with a high-speed Golden Visa entry.

Singapore remains the gold standard for entrepreneurs requiring the world’s most stable banking environment and a sophisticated Strategic Gateway to the East. However, there are complex entry requirements.

Hong Kong is the essential hub for those whose business models are inextricably linked to North Asian trade and high-volume, high-standard financial services.

The Hub Comparison: 5 Key Questions

Which jurisdiction is fastest for residency?

Dubai is currently the fastest, with Golden Visas often processed in weeks. Singapore and Hong Kong involve more rigorous background checks and longer lead times.

Is there corporate tax in Dubai now?

Yes, the UAE introduced a 9% corporate tax on profits above 375,000 AED. However, many free zone companies still enjoy 0% tax under specific conditions.

Can I open a bank account remotely in Singapore?

While some digital banks allow it, traditional Tier 1 banks almost always require a face-to-face meeting or an established residency/employment pass.

How do these hubs handle the Common Reporting Standard (CRS)?

All three are signatories to CRS. This means they share financial account information with your home country's tax authorities automatically.

Which is better for a Family Office?

Singapore is widely considered the leader due to its specific tax incentive schemes (13O and 13U) designed specifically for family offices.